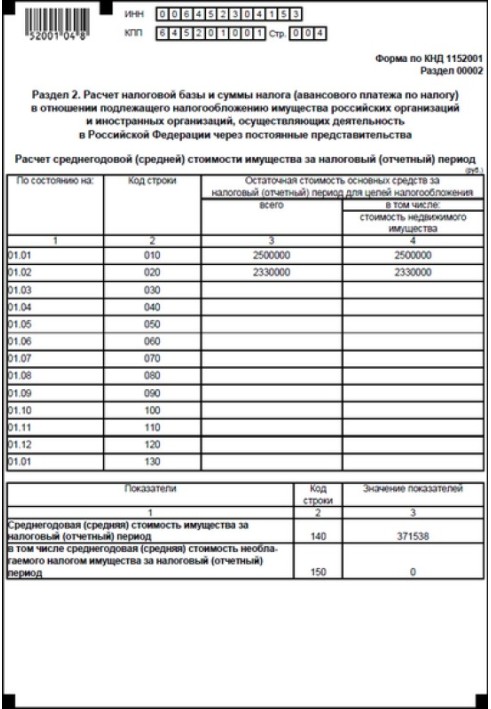

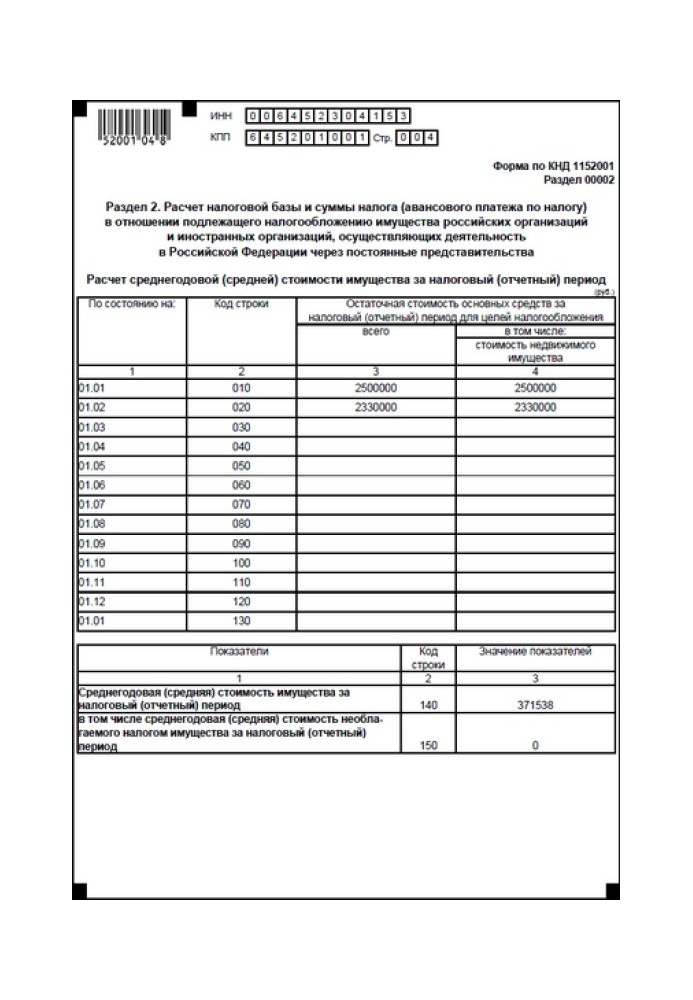

Property tax

Instant download

Instant download

after payment (24/7)

Wide range of formats

Wide range of formats

(for all gadgets)

Full book

Full book

(including for Apple and Android)

The book discusses the general characteristics of the property tax of organizations, the features of property taxation of various business transactions, and property tax benefits. Tax calculation issues are analyzed taking into account changes in legislation that came into force in 2006. Particular attention is paid to the changes made to PBU 6/01 “Accounting for fixed assets”, innovations in 2006 and 2007. In particular, from January 1, 2006, assets intended to provide organization for a fee for temporary possession and use or for temporary use for the purpose of generating income. Also, adjustments have been made to PBU 6/01 that define the rules for the assessment and revaluation of fixed assets. These and a number of other important points that directly affect the procedure for calculating and the amount of property tax for organizations are reflected in this manual. The manual is intended for accountants, auditors, financial managers and company directors.

Data sheet

- Name of the Author

- Анна Клокова Валентиновна

- Language

- Ukrainian