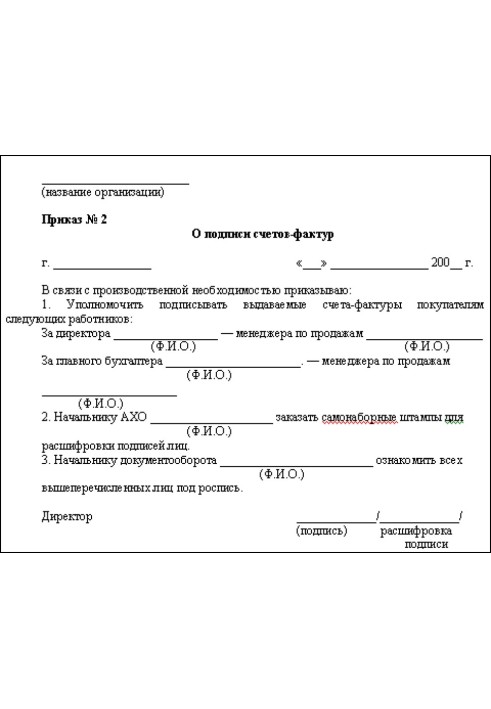

All about invoices

Instant download

Instant download

after payment (24/7)

Wide range of formats

Wide range of formats

(for all gadgets)

Full book

Full book

(including for Apple and Android)

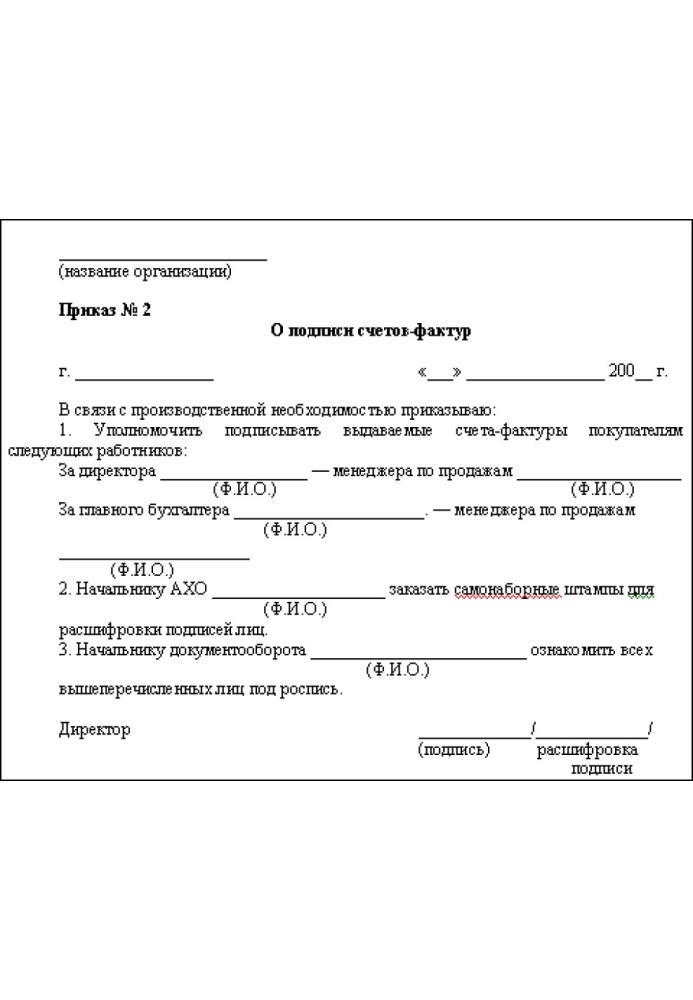

The new procedure for filling out and using invoices is discussed in detail, including when returning goods, selling at a discount, providing utilities, and performing work. The rules of accounting and tax accounting are described in detail, which is especially important when claiming VAT for deduction. Practical recommendations are given for difficult situations, such as when invoices are issued late or goods arrive without an invoice. It is shown how to make corrections to an invoice so that there are no disagreements with the tax authorities. Numerous examples from judicial practice are given. For accountants, economists, managers and heads of organizations, as well as for auditors and tax officials.

Data sheet

- Name of the Author

- Анна Клокова Валентиновна

- Language

- Ukrainian