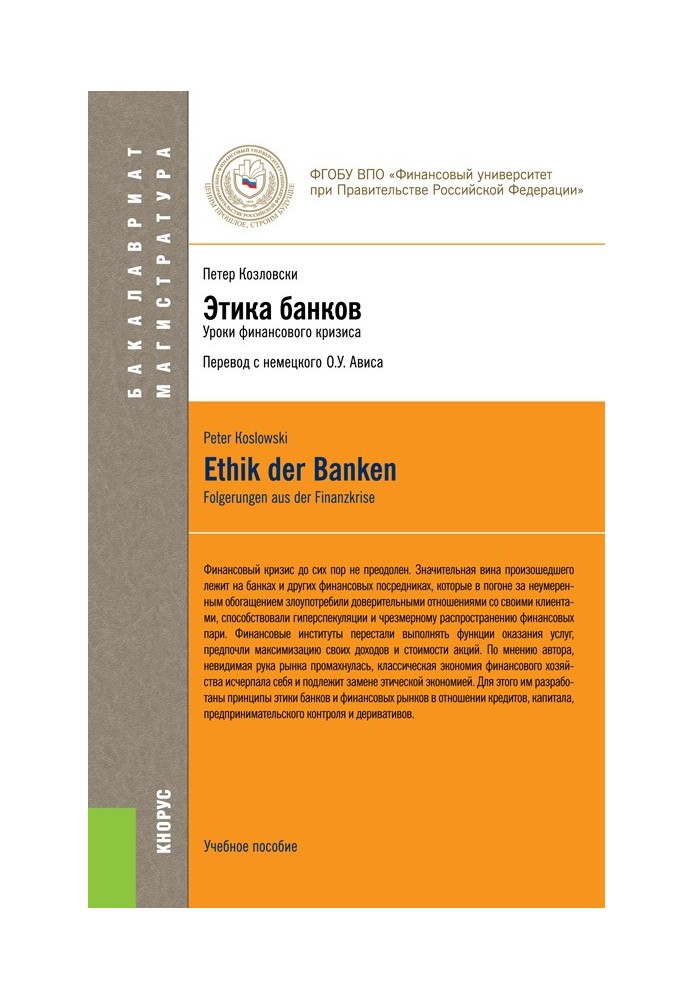

Ethics of banks

Instant download

Instant download

after payment (24/7)

Wide range of formats

Wide range of formats

(for all gadgets)

Full book

Full book

(including for Apple and Android)

The financial crisis that began in 2008 has not yet been overcome. Much of the blame for what happened lies with banks and other financial intermediaries, who, in the pursuit of immoderate enrichment, abused their trusted relationships with their clients, contributed to hyper-speculation and excessive distribution of financial bets. Financial institutions have ceased to perform the functions of providing services, preferring to maximize their income and stock value. According to the author, the invisible hand of the market has missed, the classical economy of financial management has exhausted itself and must be replaced by ethical economy. For this purpose, he developed the principles of ethics of banks and financial markets in relation to loans, capital, business control and derivatives. The proposed book is of undoubted interest for scientists studying the problems of market philosophy, the essence of finance and credit, the history of banking and stock exchange business, and will be useful to managers of commercial banks when developing and complying with development strategies and ethical codes, it is recommended for students of economic and financial institutions and universities to form a more complete understanding of the modern financial market, and is also intended for everyone who is trying to understand the true causes of the global financial crisis.

Data sheet

- Name of the Author

- Петер Козловски

- Language

- Russian

- Translator

- Олег Ушерович Авис