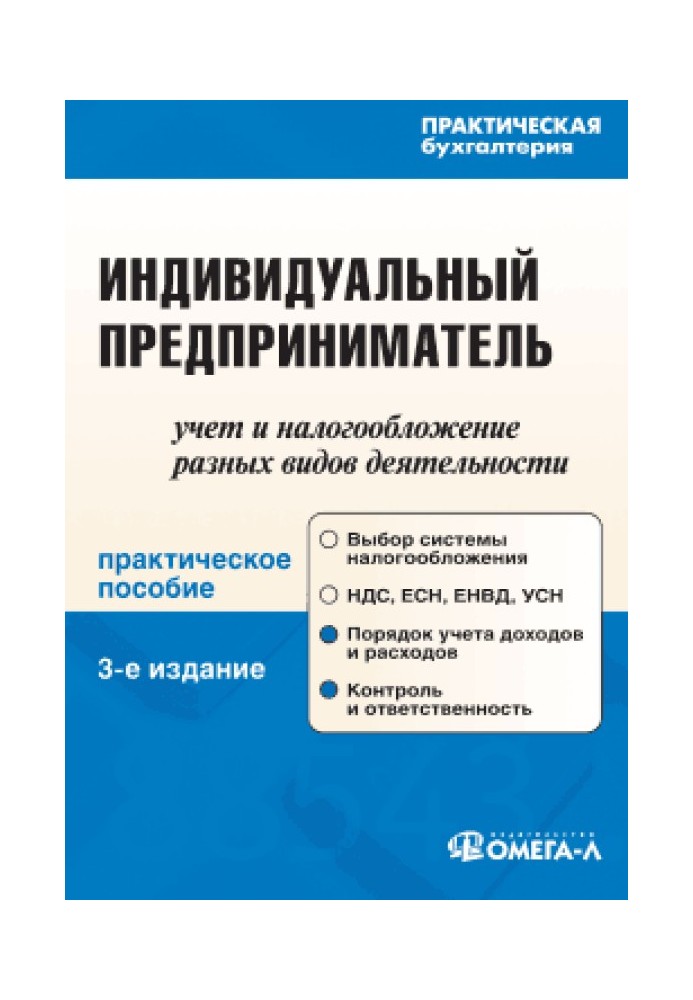

Individual entrepreneur: accounting and taxation of various types of activities

Instant download

Instant download

after payment (24/7)

Wide range of formats

Wide range of formats

(for all gadgets)

Full book

Full book

(including for Apple and Android)

This practical guide is intended for future entrepreneurs who are planning their business activities, as well as individual entrepreneurs who are already operating in the market. Having decided to start a business, you need to decide not only on the pricing policy, but also register with the Federal Tax Service, open a current account, and obtain a license if the business activity is subject to licensing. It is especially important to understand whether this type of business activity is one that is necessarily subject to a single imputed tax or not. If not, then you need to make a choice between other taxation systems: general, simplified or for agricultural producers. The pages of our book discuss in detail the issues of organizing business activities, the procedure for registering an individual entrepreneur, registering, and so on. The features of various tax systems are explained, from the procedure for transitioning to a particular taxation system to the procedure for filling out tax reports. Individual entrepreneurs who are already registered and engaged in business activities will be able to glean information from this manual about current changes in the legislation of the Russian Federation. The book will help entrepreneurs, accountants, and economists , lawyers, as well as citizens who plan to start economic activity. The manual will be of interest to students and teachers of economic specialties.

Data sheet

- Name of the Author

- Антонина Вислова Владимировна

- Language

- Ukrainian